how to make a TDS payment online:

Tax is deducted at source (TDS), and payments for TDS are made online under this method. When you pay for things like rent, interest, commission, etc., you can deduct taxes. The person making these specified payments is in charge of deducting the TDS, paying the TDS, and paying the remaining balance to the recipient of the payment who is legally entitled to it.

The TDS rate chart provides access to the whole list of these specified payments as well as the rate of TDS that will be taken.

The person who is deducting the TDS must submit the money deducted to the government by the due dates indicated. The steps to pay TDS online are as follows:

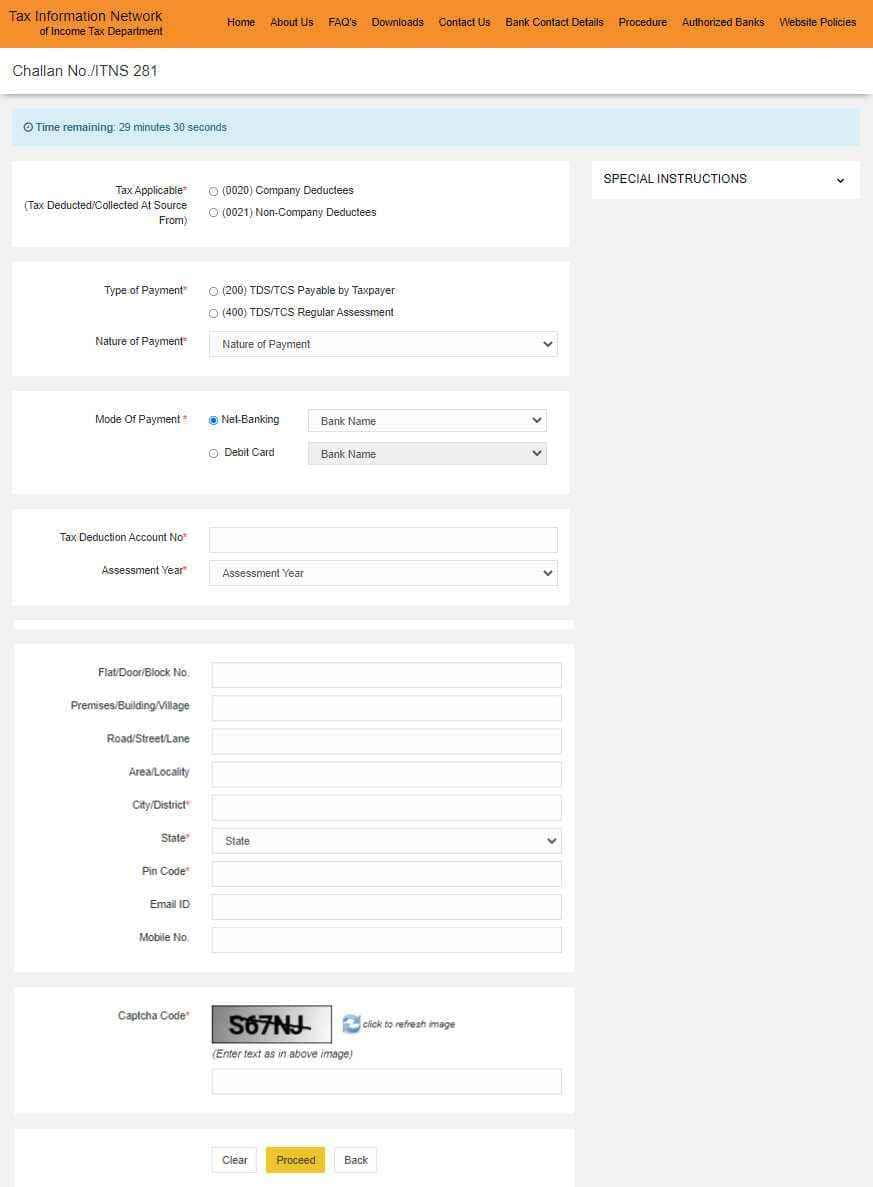

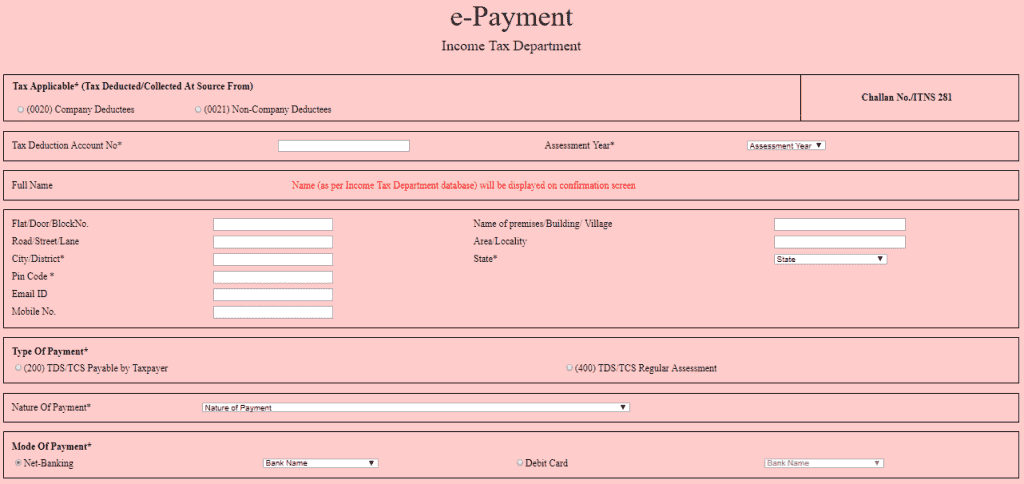

How to Make TDS Payment

- If you deducted TDS while paying a firm, choose "Company Deductees" under "Tax Applicable." Otherwise, choose "Non-Compay Deductees."

- Type in the assessment year and TAN for which the payment is being made.

- Type the "Pin Code" and choose the "State" option from the drop-down menu.

- Decide whether to pay for TDS that was deducted and paid by you or TDS that was assessed on a regular basis.

- From the drop-down menu, choose the "Nature of Payment" and the "Mode of Payment."

- Click on "Submit" button.